Background

At the annual Nareit REITweek Conference in Midtown Manhattan, NYC, we had 56 management meetings over four dynamic days with teams representing the full spectrum of real estate subsectors. Reflecting the energy of our packed schedule, the city itself was the most vibrant and bustling we’ve seen since pre-covid. We bookended the conference with insightful property tours—ranging from retail and office spaces to funeral homes and skilled nursing facilities—led by company management teams, providing valuable on-the-ground perspectives.

Big Picture Takeaways

Business Outlook Better than Feared but Different Sectors in Different Stages

Ahead of the Nareit conference, many REITs released business updates, which—alongside solid Q1 results—contributed to a cautiously positive tone. Several teams noted that both the business and leasing environments were better than feared, especially post-“Liberation Day.” We attribute this resilience to strong REIT balance sheets, solid expense control, and a surprisingly robust U.S. consumer.

That said, sector dynamics vary. Retail feels near a peak, with sentiment strong and occupancy near record highs. Industrial remains in a downturn, with tariffs pushing a potential inflection point further out. Storage appears to have bottomed, though the usual moving catalyst tied to home sales remains absent. Apartments entered the year with high expectations, but rent growth peaked earlier than usual in May. Senior Housing continues to outperform, though valuations are becoming stretched; still, favorable long-term fundamentals—aging demographics and limited new supply—support continued earnings and dividend growth.

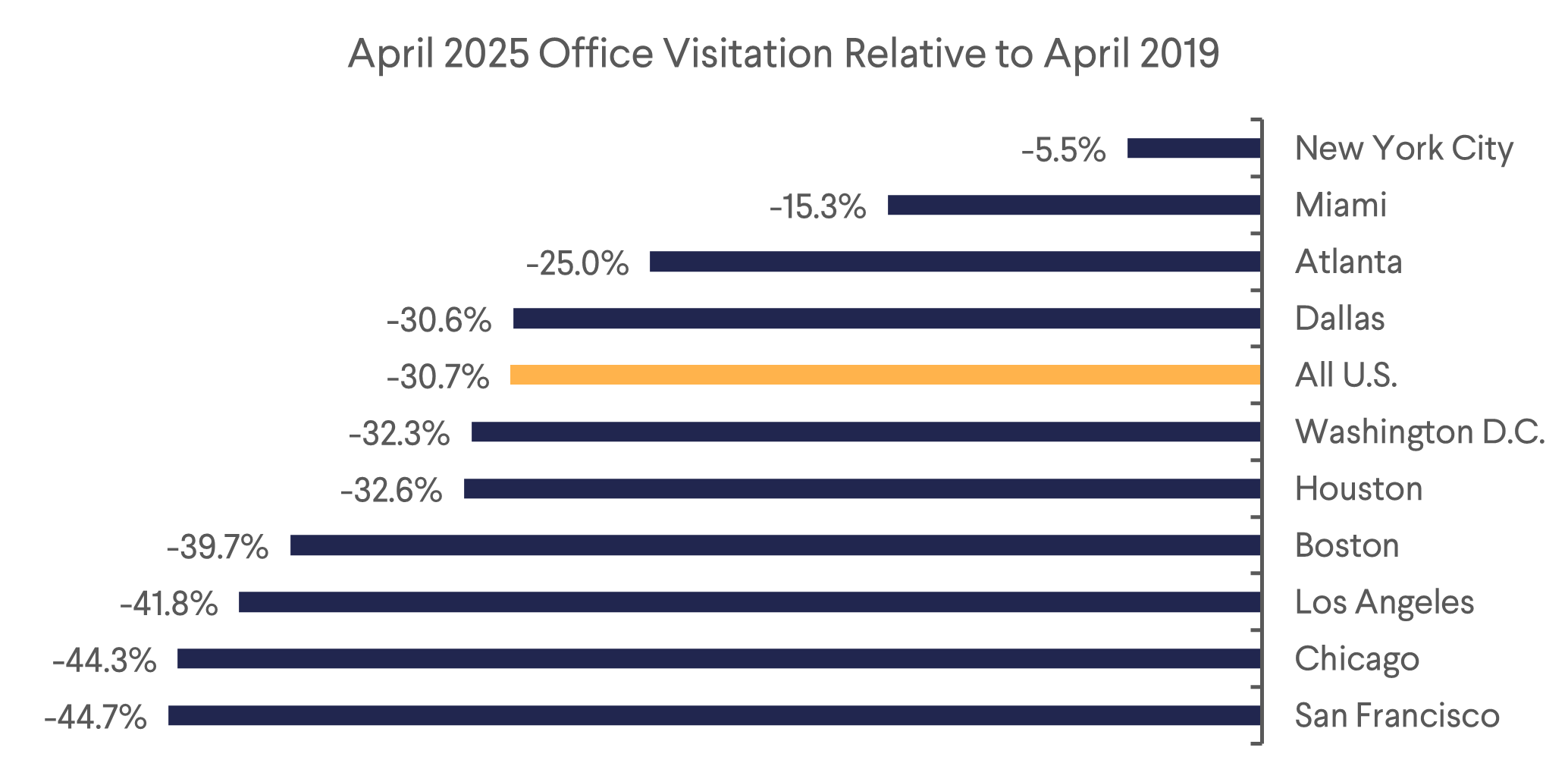

Surprisingly, some of our most optimistic meetings were with Office REITs. Return-to-office trends are gaining traction, driving leasing demand—especially for Class A, amenitized space, which is the core focus of most REIT portfolios.

Rising Development Costs = Lower Future Supply

In most real estate sectors, it’s now more expensive to build than buy assets, as rising land, material, and labor costs make new developments financially unfeasible. Development activity continues to decline, constrained by elevated construction costs and persistently high interest rates. At the same time, tighter financing conditions—marked by higher borrowing costs and reduced capital availability—have made new projects harder to justify. These pressures are reinforcing a supply-demand imbalance that benefits existing property owners. Even once-booming sectors like Industrial, Storage, and Apartments are now seeing guidance toward supply declines. In our view, this trend is one of the most constructive in the real estate space and should support REITs’ ability to raise rents above inflation over time.

Optimism on West Coast Recovery

Sentiment around the West Coast—especially San Francisco—was notably improved in our meetings. Tech companies are increasingly mandating return-to-office policies, and firms benefiting from the AI boom are expanding their footprints in the city. For example, Nvidia CEO Jensen Huang recently announced the company is actively seeking office space in San Francisco. While crime and homelessness remain concerns, we heard several anecdotes suggesting these issues are easing and the city's quality of life is improving.

Essex Property Trust (ESS), a major West Coast apartment REIT, echoed this optimism. The CEO was bullish on San Francisco, citing rising occupancy, rents, and reduced concessions and bad debt—largely driven by high-earning tech workers returning to the Bay Area. In contrast, she was bearish on Los Angeles, where vacancy is rising and asset values are declining, attributing the weakness to ongoing quality-of-life challenges and a slowdown in the film and TV industries.

Office REITs with West Coast exposure expressed growing conviction in a recovery, particularly in San Francisco, citing a clear uptick in tenant tour activity and leasing velocity. Nearly 50% of venture capital funding for AI companies is directed to San Francisco-based companies. The rapid growth of AI startups is catalyzing broader confidence in the market, encouraging other tech and professional services firms to recommit to urban office footprints. This optimism reflects a deeper recalibration: as AI reshapes the tech landscape, proximity to talent is once again becoming a strategic imperative that benefits core urban markets like San Francisco.

Macro Uncertainty Leads to Pauses in Major Investment Decisions

A key theme across our meetings was that policy uncertainty—particularly around U.S. tariffs and interest rates—is delaying investment decisions for both tenants and landlords. Persistently high interest rates and borrowing costs have raised hurdle rates for new investments, dampening transaction activity across the real estate landscape. With the 10-year Treasury yield near 4.5% and 30-year mortgage rates in the high-6% range, transaction volume remains low.

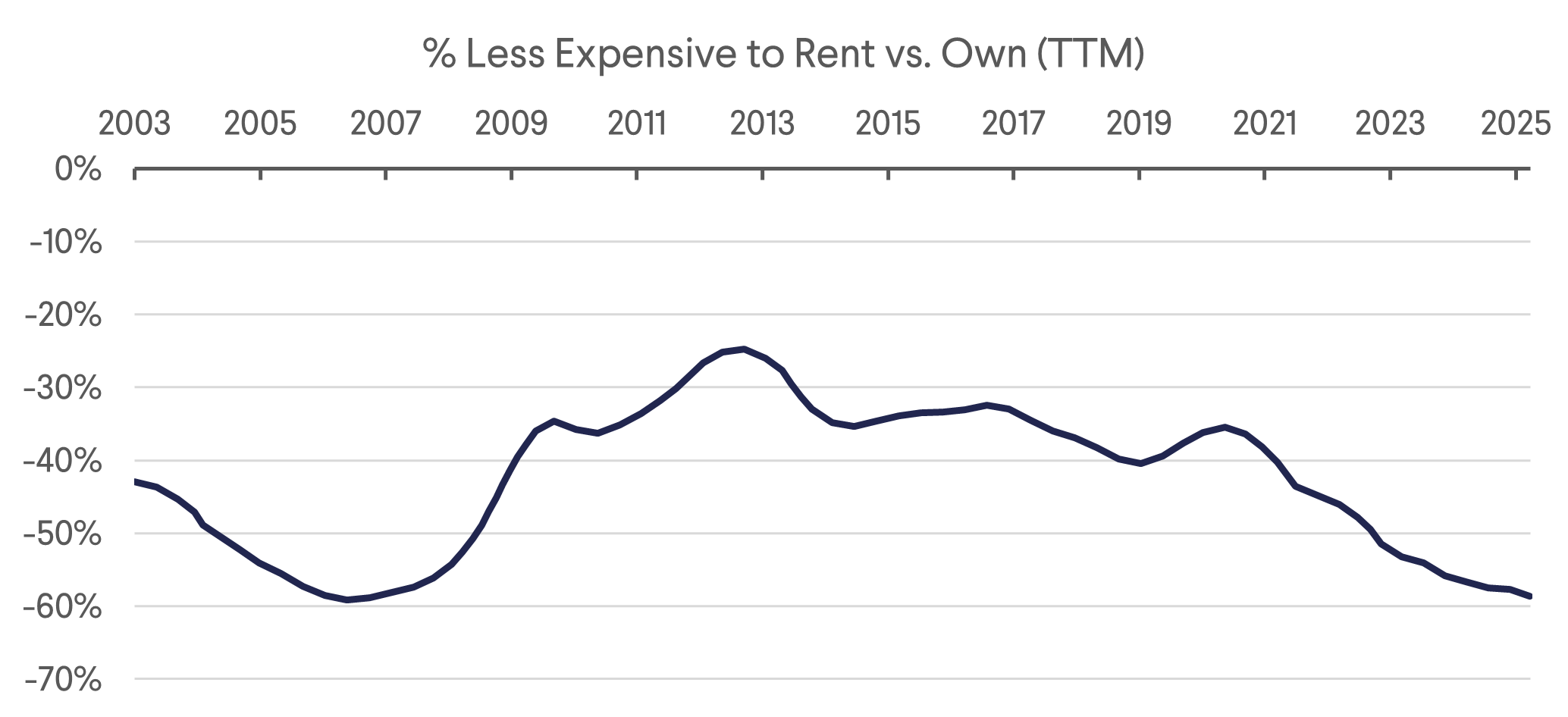

This slowdown has mixed implications across sectors. For triple net and gaming REITs, which rely on external growth, the lack of deal flow is a headwind. In life sciences, biotech and pharma tenants are delaying leasing decisions. However, in housing, higher mortgage rates have made renting up to 60% cheaper than buying (Figure 1), driving demand for rentals and reducing turnover—benefiting Single-Family Rental and Apartment REITs through higher occupancy and renewal rates.

In senior housing and skilled nursing, high rates are sidelining private equity buyers, allowing well-capitalized Healthcare REITs to acquire properties with long-term demographic tailwinds at more attractive prices.

While activity is currently muted, we expect a reversion to the mean over time—particularly in key sectors like U.S. single-family housing, where transaction volumes are at three decade lows.

Sector Takeaways

Office

Office REIT management teams were remarkably positive about their prospects. New York has led the charge in returning to office, with office attendance estimates roughly in-line with pre-pandemic levels (Figure 2). Other major office markets now appear poised for a similar rebound, including on the West Coast. Management teams were especially upbeat about San Francisco, with one executive estimating c. 7mn sf. of office requirements shopping space in the San Francisco market—up from 6mn a year ago and 3-3.5mn two years ago. The city, of course, benefits from a robust startup economy with AI startups being a significant driver of office demand in 2024-25. Other tech-heavy markets such as Portland, OR and Bellevue, WA are also seeing increased activity as larger corporates, some of whom overcorrected when downsizing office footprints in 2022-23, return to the leasing market.

Most Office REITs have a clear cost of capital advantage over private owners. Executives are starting to see a higher volume of compelling acquisition opportunities, particularly as large pension funds look to reduce their direct exposure. In many cases, REITs are also better positioned to underwrite assets facing leasing risk or requiring capital investment, given their access to public debt markets and operational expertise.

Data Center and Telecom

Demand commentary across our meetings was broadly constructive, with Data Center REITs highlighting both near-term momentum and longer-term tailwinds. Retail-oriented platforms are seeing improving sales velocity, particularly in sub-1MW deployments with strong interconnection needs. Meanwhile, hyperscale demand remains robust but lumpy, with 2025 leasing activity expected to mirror the record-setting pace of 2023 and 2024, albeit likely weighted toward the back half of the year.

Data center operators are increasingly focused on AI readiness as a differentiator, not just in terms of power and cooling, but also in connectivity and capacity planning. This includes efforts to better identify when customers are using capacity for AI and to prioritize Tier 1 markets, where scale and connectivity can support larger, longer-duration deals. We’re also seeing early signs of convergence between digital infrastructure and adjacent verticals—such as subsea cable landing stations—where small capital commitments can unlock big strategic value.

This mirrored what we heard in a meeting with American Tower (AMT), who recently launched a true edge computing data center with 1MW of capacity constructed near the base of a cell phone tower. Edge computing is a distributed computing concept that processes data closer to where it’s being used, enabling faster response times for latency-sensitive applications, e.g. autonomous drone delivery. Although the company has several thousand sites suitable for this type of edge computing facility, this initial build serves more as a playground for partners to develop use cases and proofs of concept. The domestic tower business remains strong, with c. 5.5% growth and low capex requirements enabling Telecom REITs to invest in technology leadership.

While B2B AI use cases remain modest, the infrastructure arms race is well underway, and public platforms with scale, balance sheet flexibility, and operational depth appear best positioned to capture the next leg of growth.

Industrial

The industrial sector has held up better than expected following the April tariff announcements, though tenant decision-making remains slow. Market rent growth remains negative, and vacancy rates are rising, pushing the anticipated recovery further out. Southern California continues to be mentioned as the weakest market. Still, structural demand drivers—led by e-commerce—remain intact. Prologis (PLD) reiterates that online sales require three times more space than in-store retail, supporting long-term demand for logistics assets.

PLD reports in-place rents are ~25% below current market rates, while market rents remain ~20% below replacement cost—positioning the sector for strong rent growth once conditions stabilize. With limited new supply, the long-term outlook remains favorable. On capital allocation, PLD continues to prioritize its $40 billion land bank and is expanding into data centers, with 3–4 GW of potential capacity in the medium term and up to 10 GW longer term.

Storage

Self-storage demand appears to be stabilizing after a period of weakness tied to low housing turnover. While still subdued, demand is no longer declining, and early signs of recovery are emerging. Public Storage (PSA) reported a return to positive same-store revenue growth in 2025, supported by broad market improvements. Meanwhile, new supply is easing, contributing to a more balanced outlook.

Digitalization continues to be a key driver, as the sector’s operational complexity favors larger, tech-enabled operators like listed REITs. Investments in technology and solar are expected to cut labor and energy costs, with PSA’s CEO noting the industry is still in the early stages of capturing these efficiency gains.

Healthcare

Over the past two years, healthcare REITs focused on senior housing (SHOP) and skilled nursing (SNF) have significantly outperformed the FTSE Nareit All Equity REIT Index (+18.3%), with Welltower up 99.6%, Ventas 49.3%, and Omega Healthcare 40.8%. This strong performance reflects low entry valuations post-COVID and a highly supportive supply-demand backdrop.

Today, valuations and expectations are higher, but the long-term outlook remains compelling. The first wave of baby boomers is turning 80, driving demand growth, while new supply remains well below trend due to high development costs—rents would need to rise ~30% to justify new construction. Management teams consistently emphasized that it’s currently cheaper to buy than build.

This dynamic, combined with limited private competition (due to high debt costs and operational barriers), has fueled robust earnings and external growth. SHOP and SNF REITs are using their improved cost of capital to pursue sizable acquisitions: YTD, Welltower has acquired $6.2B in assets, Ventas $900M, Omega $423M, and CareTrust $948M with another $500M in the pipeline. SHOP assets are trading at 7–8% cap rates; SNF assets at 9–10%.

Despite elevated valuations, continued FFO and dividend growth appears likely, supported by high replacement costs, constrained supply, and accretive acquisitions at premiums to NAV.

Life Science

Life Science is probably the most challenged sector in real estate. Lab space—typically leased by biotech and pharmaceutical firms — has seen demand fall sharply as these companies, which rely heavily on venture capital to fund speculative R&D cycles, struggle in today’s high interest rate environment.

These funding headwinds coincide with a major supply glut. Vacancy rates have climbed above 30% in key markets like San Francisco and Boston, and absorption has stalled. Political uncertainty is adding pressure: under the Trump administration, proposed budget cuts to the FDA and NIH, along with potential changes to U.S. drug pricing policy, have introduced further risk to tenant profitability and future demand for space.

As a result, the sector has de-rated meaningfully. Alexandria Real Estate (ARE), the leading life science REIT, is down ~68% from its COVID highs. Yet despite market-wide distress, ARE has held occupancy at 91.7%—albeit with lower rents and increased concessions. The company maintains an investment-grade balance sheet and a 7.3% dividend yield, and management reaffirmed the dividend’s stability, saying they would be “loathe to cut.”

The key question now: has the sector bottomed, or is more downside ahead? With sentiment deeply negative and the stock trading 1.7 standard deviations below its 5-year P/FFO average, much of the bad news may already be priced in—making any slightly positive surprise a potential catalyst.

Net Lease

The net lease sector remains resilient, supported by a high concentration of service-oriented tenants less affected by global trade and tariffs. The net lease structure shields revenue unless tenant bankruptcies rise significantly, and bad debt levels remain manageable. Despite interest rate volatility, net lease REITs are steadily advancing acquisition plans. While rate fluctuations dampen transaction volume, they also reduce competition.

While U.S. net lease cap rates average mid-7%, there is a notable bifurcation in cost of capital within the sector. Some REITs maintain a cost of capital advantage that enables continued external growth through accretive acquisitions, while others are limited in their ability to pursue new investments. Some REITs fund acquisitions via dispositions or turn to international markets. Realty Income and W. P. Carey, for instance, noted more attractive acquisition spreads in Europe, benefiting from debt financing costs 140–150 basis points lower than in the U.S., boosting returns overseas.

Retail

Retail REITs were surprisingly optimistic in their assessment of the current environment and outlook, despite the potential macroeconomic impact from new tariffs remaining unclear. Leasing activity has shown no visible signs of slowing since Liberation Day, and sentiment at the ICSC conference in Las Vegas — the industry’s largest — was broadly positive. Mall REIT Simon Property even called it the best conference in a decade.

A key theme was the scarcity of high-quality space, which continues to drive solid rent momentum. REITs reported increased Signed-Not-Opened (SNO) pipelines, providing strong visibility into revenue growth into 2026. The impact of recent retail bankruptcies is being effectively managed, with disruptions tracking below guidance and no new major risks flagged.

A growing volume of assets for sale (some indicated USD 7–10bn) is coming to market, presenting acquisition opportunities. REITs expressed confidence in their ability to deploy capital into these deals, although competition for high-quality assets is increasing. Despite the weak share price performance in 2025, which has deteriorated the cost of equity for the sector, REITs highlighted a variety of funding strategies. Some secured forward capital at favorable terms last year, others have debt capacity, and many are actively engaging in asset recycling to fund new investments.

Asset Tour Pictures

Macerich (MAC) Tour of Queens Center – 2 June 2025

|  |

Service Corporation (SCI) Tour of NYC Funeral Locations – 2 June 2025

|  |

Vornado Realty (VNO) Tour of PENN 2 – 4 June 2025

|  |

Omega Healthcare (OHI) Tour of Senior Housing Assets – 5 June 2025

|  |

Download the PDF version of the report here