Market Outlook

The macro backdrop remains favorable for Asian REITs and currencies as inflation in Asia ex-Japan cools and peaks in Japan. Weak US payrolls announced for July along with large revisions lower for May and June payrolls, combined with continued Tariff turmoil, will lead to Fed easing again. The Fed will start to worry about the employment side of its dual mandate. Asian economies (ex-Japan) are seeing stable or falling inflation and there are only pockets of oversupply in some Asian RE markets. Most asset types across the markets where we are active have high occupancy and growing rents. Asian RE securities could prove to be safe havens in an equity market context if the USD continues to weaken as their earnings and demand are less influenced by FX volatility.

Japan

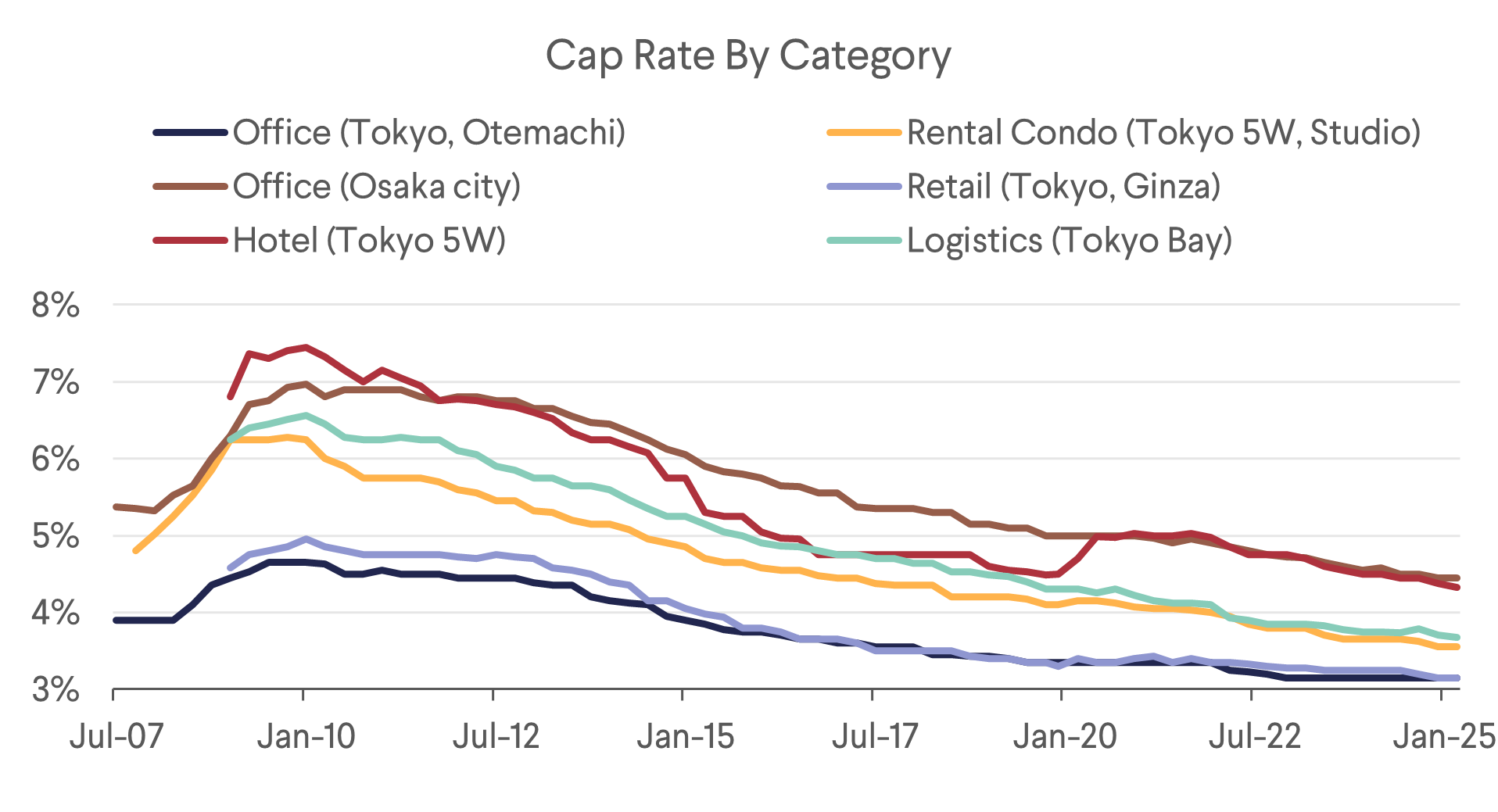

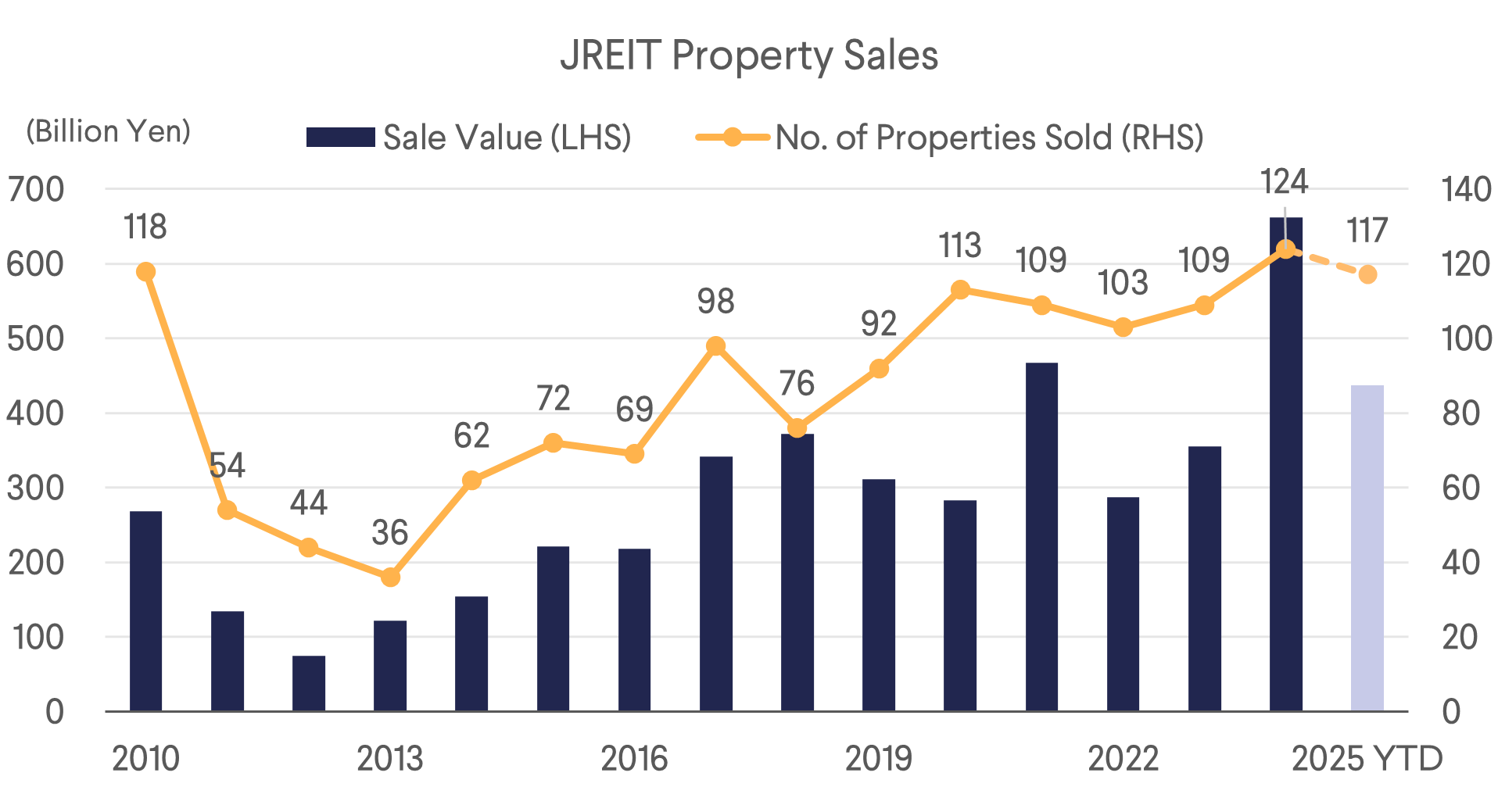

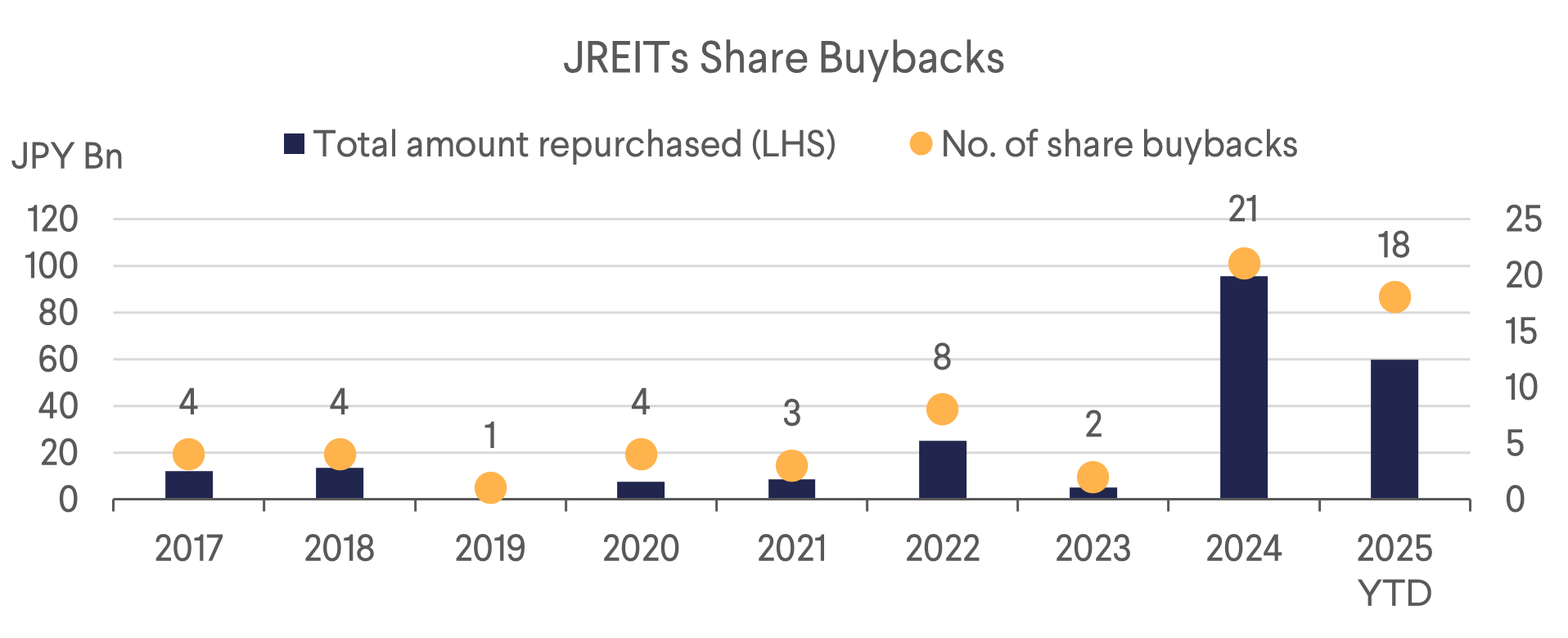

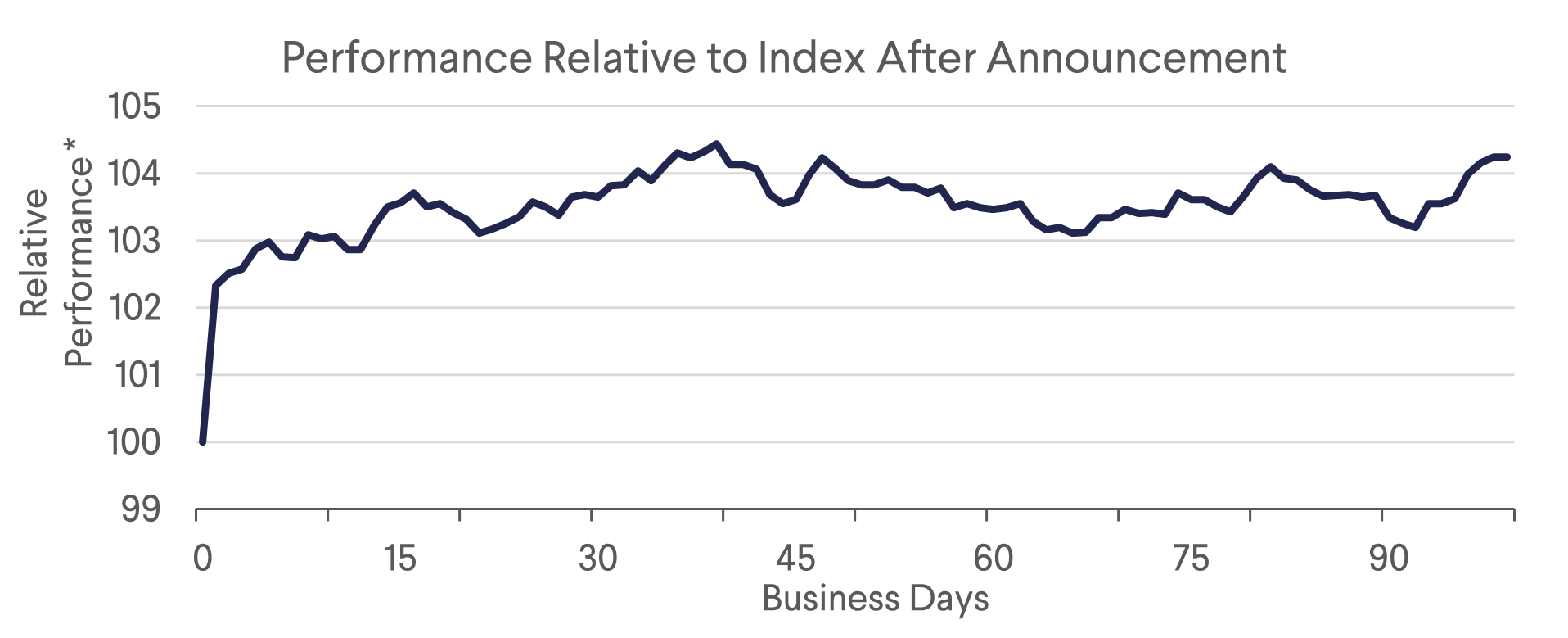

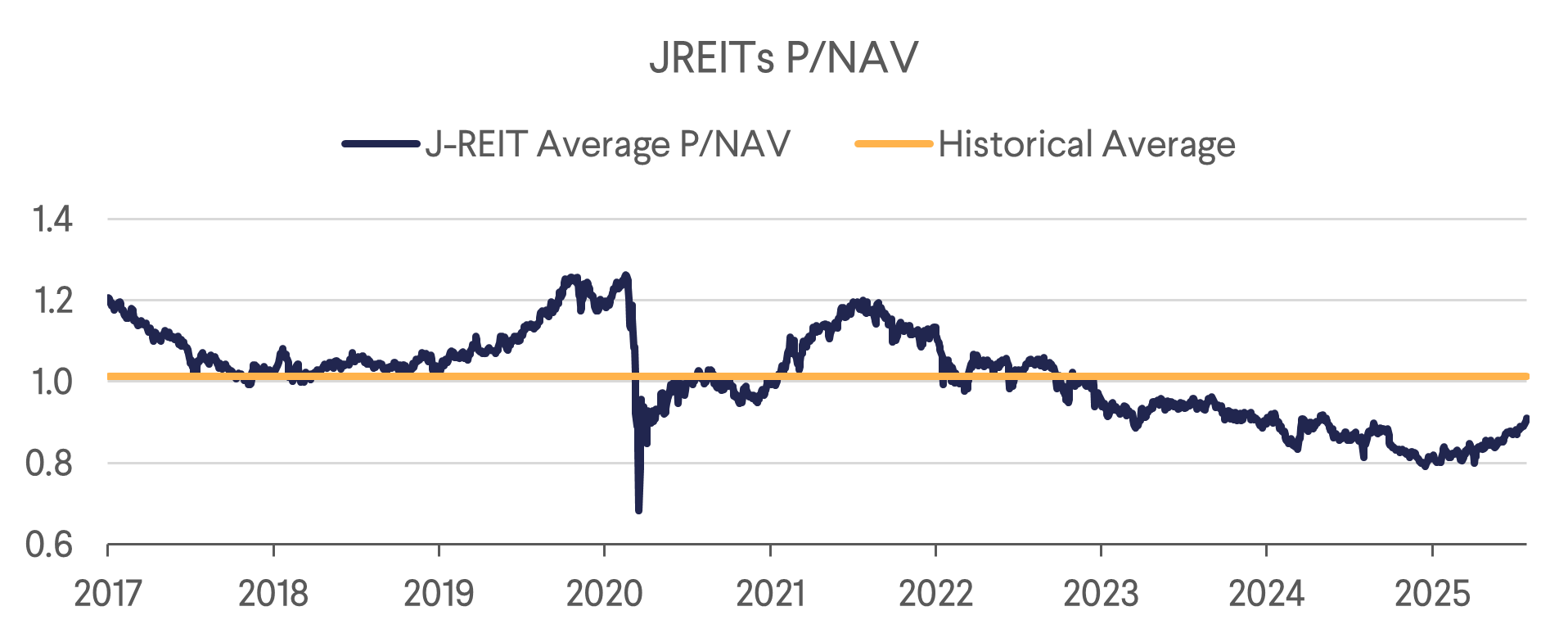

The Bank of Japan raised its assessment for inflation in its last meeting, and we believe this is moving them closer to the next hike. While rising rates have been a concern for the JREIT sector, it has had limited impact on commercial real estate transactions and JREITs have taken advantage of the strong demand for commercial real estate by selling properties to investors in record amounts. We believe in most cases these sales are of assets that may be less competitive and/or will have future capex requirements. The proceeds from the sales are often used to fund unit repurchases.

Recently, the JREIT sector has recovered as rent growth in many sectors is helping to offset interest expense increases. Given the likelihood of a Fed cut to interest rates and a hike from the BOJ, we believe this could help strengthen the JPY and reduce overall imported inflation into Japan, thus lowering the need for more aggressive tightening. A flatter yield curve would be bullish for the JREIT sector. The Big Three developers will report this week, and we expect strong sales numbers for condominium and leisure. Office rents will continue to provide upside. Historically, the large developers rarely raise their full year guidance or announce major shareholder measures at the first quarter results, so we see limited catalysts for the sector in the short term. Also, as we have commented previously, the increase in construction costs has exceeded rent growth and as a result the economic rents required to justify development have risen above current rent levels. We believe this will reduce future supply and currently we favor landlords over Developers in Japan. There is another potential risk facing the sector as well. The Chiyoda ward recently announced property measures to reduce speculation on residential properties, and we believe this might become a more widespread phenomenon. Additionally, with foreign investors also active in the residential condominium market we would not be surprised to see additional restrictions as condominium prices have moved up substantially in Tokyo over the last few years. This could potentially hurt sentiment for Developers even if it does not affect their presales which are strong due to genuine end-user demand. Our preference in the JREIT sector remains Office, Hotel, Diversified, and Logistics REITs that have the ability to grow rents and offset interest cost expenses.

Australia

The RBA surprised the market by not lowering rates at its last meeting. However, the recent inflation data released at the end of July showed slowing price pressures and it is very likely that they will lower rates when they next meet. The trimmed-mean fell to 2.7% versus the year earlier at the end of June and down from 2.9% YoY reported for the March quarter.

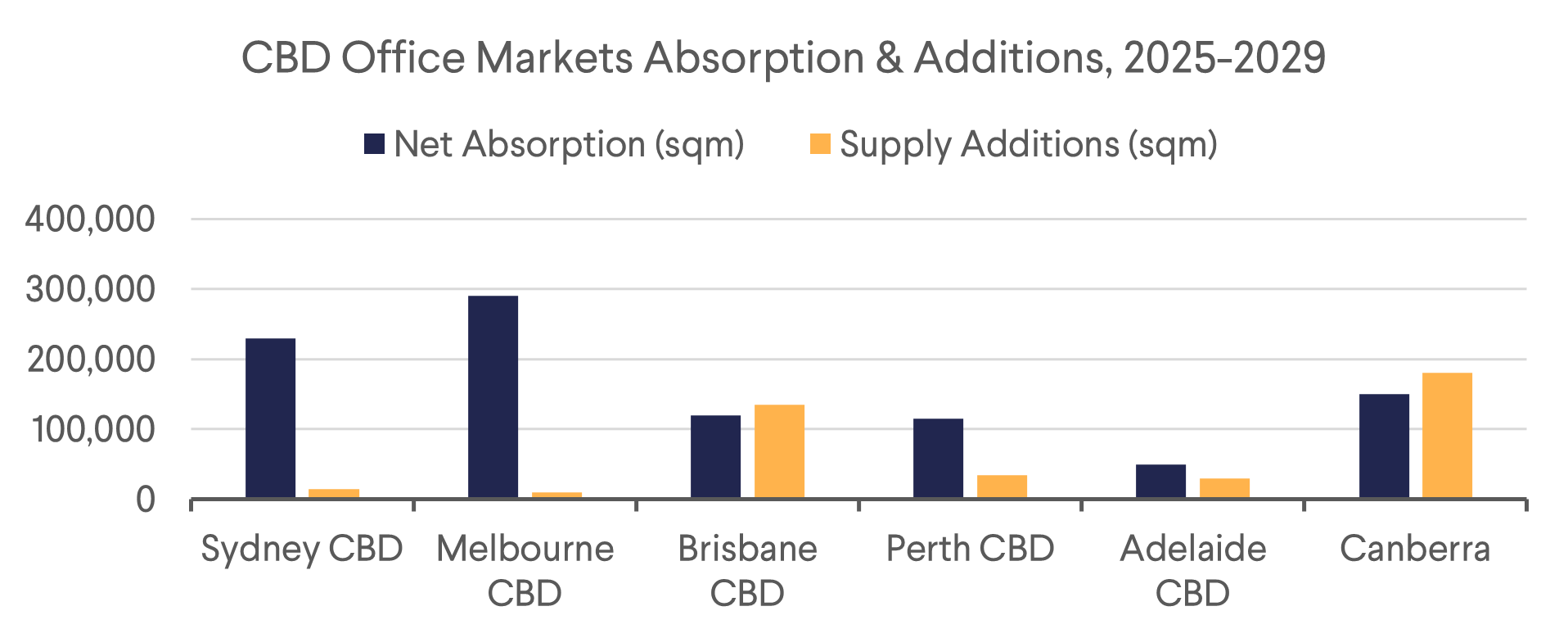

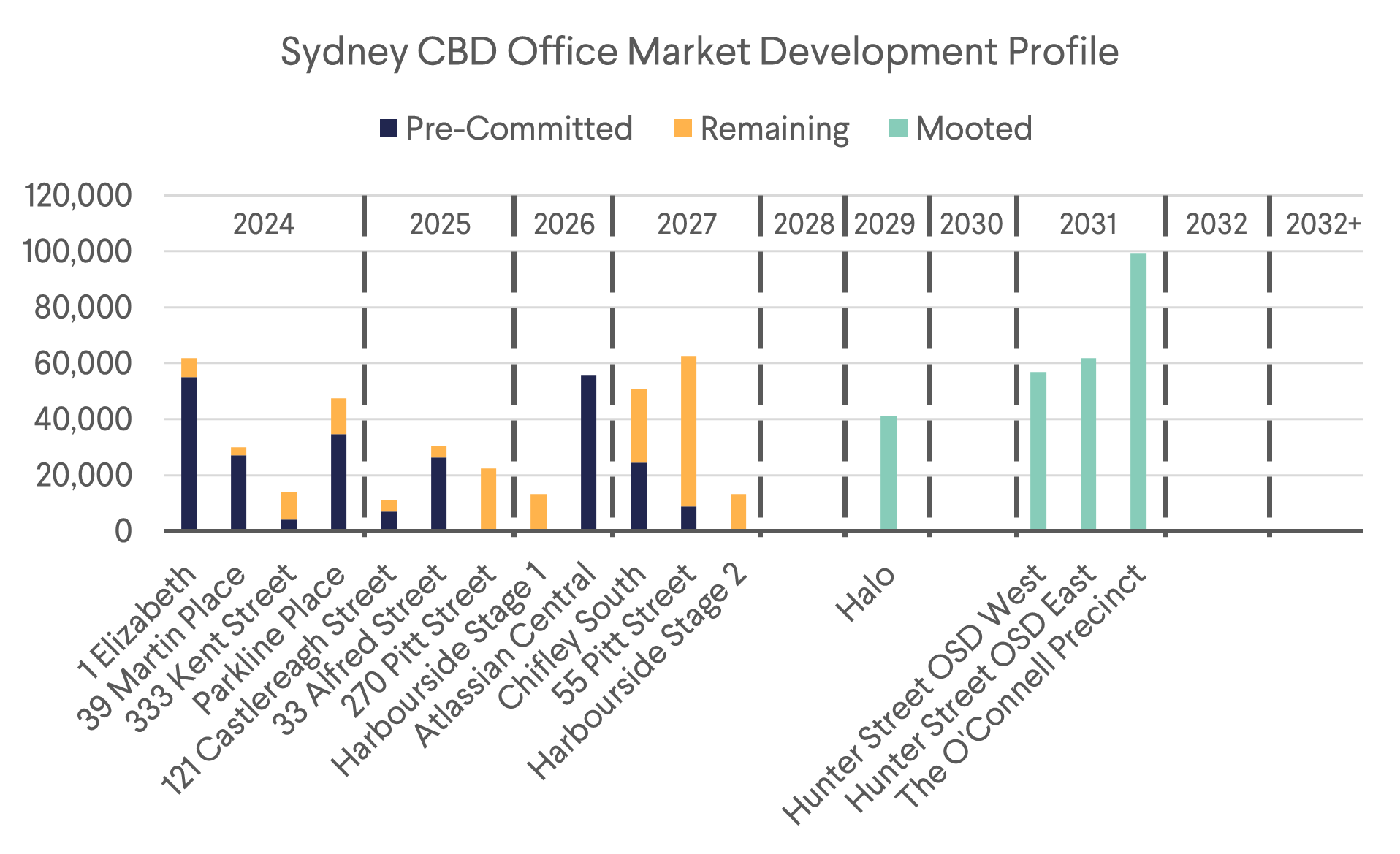

Results for the full year and guidance for the next year will be announced in August. We are confident that most names will meet or exceed guidance for the current year ending June 2025, but given the slower than expected interest rate reductions the company guidance may be more conservative on interest cost savings. The residential sector has been solid despite higher rates, but for a pickup in overall transactions to occur, lower rates are required. We remain overweight residential related REITs. Goodman Group will also be an interesting result and outlook as it traditionally gives conservative guidance of high single digits and then revises upwards. Given the change in its business model to expand its Data Center development pipeline, there could be some disappointment that they have yet to sign on JV partners or receive firm commitments from hyperscale customers. Hyperscale customers are increasingly signing lease contracts later in the development stage when they can be more certain of delivery and avoid delays that are caused by component challenges. In addition, JV partners in many cases want only to commit once tenants are signed. As a result, there is a possibility that much of the WIP (Work in Progress) will be self-funded by Goodman and as a result guidance may be a bit lower than the stock market is hoping for given the strong recent recovery and high valuation. We are seeing a strong pickup in activity in the office market and with future supply stopping, it looks like vacancy and incentives have already peaked in Sydney and Melbourne. Office related names like Charter Hall, Dexus, and Mirvac should benefit from an improvement in sentiment as office fundamentals bottom and transactions increase.

Hong Kong

The stars have aligned for Hong Kong with incremental positive news flow trickling through consistently. Falling HIBOR has provided a tailwind as it lowers both funding costs for REITs and Developers and is helping to bring down mortgage rates. Despite some intervention by the HKMA to support the HKD peg, it has not drained liquidity or pushed up HIBOR. Office demand appears to have bottomed in Central as mentioned by HK Land and evidenced by a recent uptick in activity. While still a very tough office leasing market, a recovery in stock market and IPO activity has historically led to greater office space demand in Central. The HK Stock Exchange, which is already one of the most active markets for IPO activity, is looking to ease rules to encourage even more listings. Retail sales numbers were positive for the second straight month, this time led by luxury with non-discretionary sales continuing to be solid as the population grows. Perhaps the wealth effect, less travel to Japan and overseas destinations, and some inbound recovery are the reasons for the luxury segment recovery. Even the residential sector is benefitting from additional measures (i.e., last year’s removal of stamp duties for foreign buyers). Currently, there is discussion about creating a “Property Purchase Capital Connect” program mirroring the current Stock Connect. For the program, as announced by the HK Financial Secretary at the end of July, the government is working with mainland authorities to find a way to ease cross-border fund transfers and make it easier for incoming mainland talent pass holders to purchase property in Hong Kong. The impact could be substantial with one broker estimating it could create 45k units of demand, 88% of the amount of properties sold in 2024. Despite their strong run, HK real estate securities remain undervalued. We prefer landlords and REITs and remain optimistic on Retail REITs, Link REIT, and Fortune REIT, which are beneficiaries of population growth and potentially new additions to HK Stock Connect with the mainland. HK Land remains our preferred non-REIT due to its strong investment income and commitment to narrow its NAV discount by returning capital via buybacks and dividends and focusing on becoming a landlord by existing residential development. Given its strong run, we would not be surprised to see some profit taking but think that the company has less competition from the larger developers that appear to be in no hurry to address their chronic undervaluation.

Singapore

Capital calls continue which may put pressure on some of the larger names that have outperformed, but overall the sector is not overvalued and fundamentals remain supportive. CICT, a holding of ours, announced a capital raise of USD 500m to fund the acquisition of the rest of the CapitaSpring office tower that it does not own. The debt cost that they secured has fallen to 2.7% and we expect to see them refinance a lot of their existing debt at similar or lower levels going forward as inflation in Singapore has fallen below 1%. While this may lead to some selling pressure on the other REITs, we also believe generalist equity investors will increase weighting to REITs. One potential funding source could be the banking sector (much larger by comparison), which has outperformed substantially over the past couple of years as rates rose, and will likely see net interest margins decrease due to falling rates and competition. Worker dormitory and student accommodation landlord, Centurion, is marketing a REIT listing that is likely to get a strong response due to its stable SG assets that provide essential housing to the construction industry with favorable supply and demand fundamentals and reasonable rent growth.

Download the PDF version of the report here